Millennials—those born between 1981 and 1996—are navigating a financial world unlike any generation before. From skyrocketing student debt and rising housing costs to the gig economy and inflation, this generation is faced with unique challenges. Yet, despite the obstacles, millennials also have unprecedented access to financial tools, knowledge, and opportunities to build long-term wealth.

This comprehensive guide will walk you through a five-step financial planning strategy tailored for millennials in 2025. Whether you’re just starting out or want to get your finances back on track, these actionable steps will help you save smarter, invest earlier, and build a secure future.

Why Millennials Need a Unique Financial Plan

Unlike previous generations, millennials:

- Graduated into recessions and volatile job markets

- Carry massive student debt

- Face unaffordable housing in many urban centers

- Participate in non-traditional employment (freelance, gig work)

At the same time, millennials are also:

- More tech-savvy and app-driven

- Open to digital banking and investing

- Interested in financial independence and FIRE (Financial Independence, Retire Early)

With these factors in mind, a tailored financial strategy is essential.

Step 1: Set Clear Financial Goals

You can’t plan your finances without knowing what you’re aiming for. Financial goals give your money direction—they turn vague ambitions into actionable milestones. Without clear goals, it’s easy to spend impulsively, overlook savings, or ignore future risks.

Start by categorizing your goals into short-, medium-, and long-term objectives:

- Short-term (0–2 years): Build an emergency fund, pay off credit card debt, save for a vacation or wedding, buy a new laptop.

- Medium-term (2–5 years): Down payment for a home, starting a business, career development (certifications or degrees), build a side hustle.

- Long-term (5+ years): Retirement planning, children’s education, financial independence, buying an investment property.

To make these goals stick, use the SMART Goals framework:

- S – Specific: Define exactly what you want to achieve (e.g., “Save $5,000 for an emergency fund in a high-yield account.”)

- M – Measurable: Use numbers to track progress. Set monthly targets or percentages.

- A – Achievable: Be realistic about your income, expenses, and timeline.

- R – Relevant: Make sure the goal aligns with your personal values and life vision.

- T – Time-bound: Set a deadline (e.g., 12 months from today).

Here’s an example of a SMART goal:

“I will save $10,000 for a house down payment by transferring $417 into my savings account every month for the next 24 months.”

Pro Tip: Break large goals into milestones. For instance, if your long-term goal is to save $100,000 by age 40, break it down by year and track progress annually.

Common mistakes when setting goals:

- Being too vague (“I want to be rich.”)

- Not tracking them regularly

- Letting short-term wants override long-term priorities

Top tools to help you stay on track:

- Notion or Trello: For organizing personal goal dashboards

- Empower: Net worth and goal tracking tied to your real accounts

- Google Sheets or Excel: DIY budget and progress tracking spreadsheets

- Monarch Money: Combines goal setting, budgeting, and investment tracking

Setting clear financial goals is the foundation of your entire financial plan. Once you know what you’re working toward, every dollar you earn has a job—and every spending decision has purpose.

Step 2: Create a Realistic Budget

Budgeting isn’t about restricting your lifestyle—it’s about creating freedom through awareness. A solid budget gives you control over your money, helps you track where every dollar goes, and ensures you prioritize what truly matters.

Too often, millennials live paycheck to paycheck not because they lack income—but because they lack visibility. Creating a clear, flexible budget allows you to align your spending with your goals.

Popular budgeting methods:

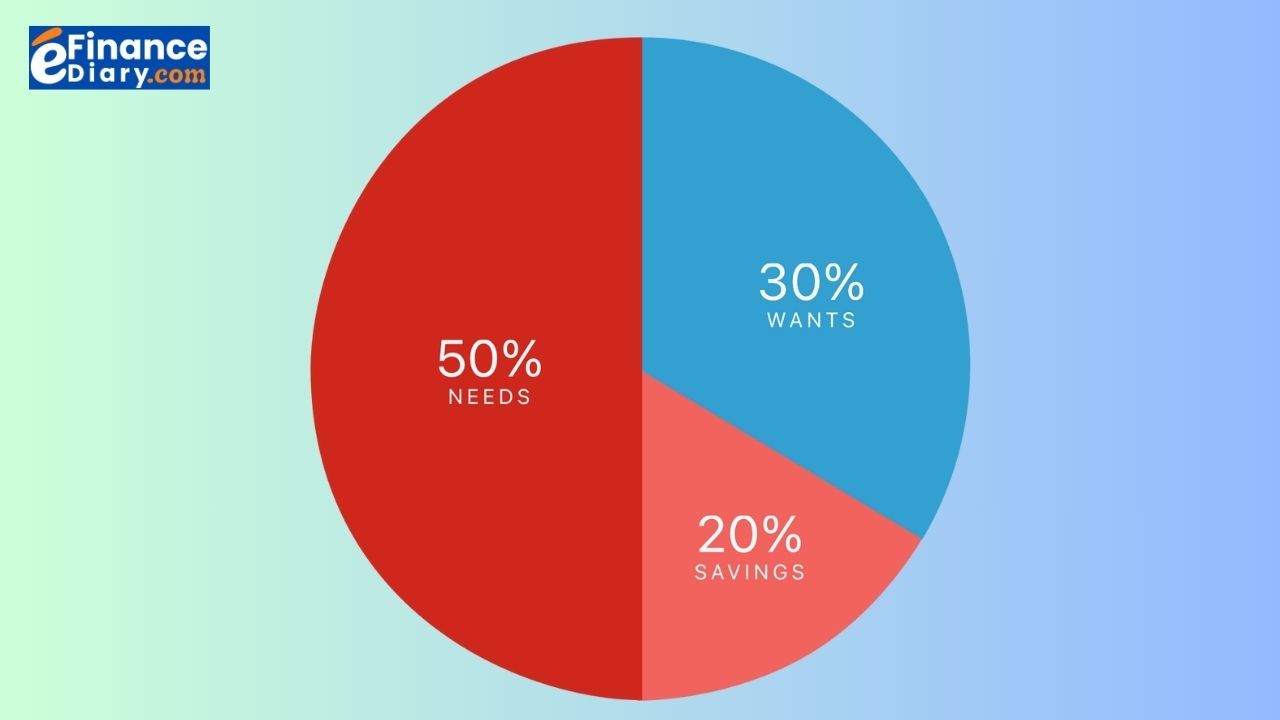

- 50/30/20 Rule:

- 50% Needs (rent, groceries, utilities, insurance)

- 30% Wants (dining out, entertainment, travel)

- 20% Savings and Debt Repayment

- Great for those who want a simple starting point.

- Zero-Based Budgeting:

- Assign every dollar a job until you’re left with zero

- Ensures intentional spending and no money “leaks”

- Works well for detailed planners and goal-oriented savers

- Reverse Budgeting:

- Set your savings target first (e.g., 25%) and plan spending with what remains

- Ideal for high-income earners or FIRE-focused individuals

How to build your first budget:

- Track all income sources (after tax): full-time job, side gigs, passive income

- List all expenses: fixed (rent, subscriptions), variable (food, gas, shopping)

- Categorize into Needs vs. Wants

- Look for trends and cut where needed

- Allocate percentages according to a method above

- Monitor and adjust monthly

Tip: Start with a 1-month spending audit. Use your bank statements or tools like Empower or Monarch Money to categorize where your money went last month.

Budgeting should be flexible. Don’t expect perfection every month. The goal is awareness, progress, and continuous improvement—not guilt or shame.

Best budgeting apps for millennials:

- You Need A Budget (YNAB): Proactive budgeting with zero-based methodology

- Mint: Free, automated tracking with goal setting and alerts

- Empower: Connects to all accounts, great for net worth and cash flow

- Goodbudget: Envelope-style budgeting with digital envelopes

- Monarch Money: Visual-friendly UI and great for couples/family budgeting

Common budgeting mistakes:

- Underestimating variable expenses (like dining out or Uber)

- Forgetting annual or irregular bills (e.g., car insurance, holidays)

- Not budgeting for fun—leads to burnout

- Skipping emergency buffer funds (for surprise expenses)

Pro Tip: Automate your savings, debt payments, and recurring bills. Then budget around your leftover discretionary income.

Visual Tip: Set up budget dashboards in Notion or Google Sheets for better clarity and daily tracking.

When done right, budgeting is like giving yourself a raise—because you’re making smarter, more intentional choices with what you already have.

Monthly Budget Tracker Example

| Category | Planned ($) | Actual ($) | Difference |

|---|---|---|---|

| INCOME | |||

| Salary | 3,500 | 3,500 | 0 |

| Side Hustle | 500 | 400 | -100 |

| Total Income | 4,000 | 3,900 | -100 |

| FIXED EXPENSES | |||

| Rent | 1,200 | 1,200 | 0 |

| Insurance | 200 | 200 | 0 |

| Internet/Phone | 100 | 95 | -5 |

| Subscriptions | 50 | 70 | +20 |

| Total Fixed | 1,550 | 1,565 | +15 |

| VARIABLE EXPENSES | |||

| Groceries | 400 | 350 | -50 |

| Transportation | 150 | 180 | +30 |

| Dining Out | 250 | 300 | +50 |

| Entertainment | 100 | 120 | +20 |

| Total Variable | 900 | 950 | +50 |

| SAVINGS & DEBT | |||

| Emergency Fund | 300 | 300 | 0 |

| Retirement (IRA) | 200 | 200 | 0 |

| Student Loan | 300 | 300 | 0 |

| Total Savings | 800 | 800 | 0 |

| Total Expenses | 3,250 | 3,315 | +65 |

| Net Cash Flow | +750 | +585 | -165 |

Step 3: Eliminate Debt Strategically

Debt is a major source of stress—and it drains your ability to build wealth. But not all debt is created equal. Strategic debt elimination means targeting the most harmful balances first, using efficient repayment techniques, and avoiding future traps.

Start by taking inventory of all your debts:

- Outstanding balances

- Interest rates (APR)

- Minimum monthly payments

- Types: credit cards, student loans, car loans, BNPL (Buy Now Pay Later), personal loans

Common millennial debts:

- Credit cards (APR often 18–25%) — revolving balances quickly compound

- Student loans (federal/private) — often large and long-term

- Auto loans — sometimes inflated by lifestyle purchases

- Buy Now Pay Later (BNPL) — easy to accumulate and forget

Step 1: Organize and prioritize

- Make a spreadsheet listing each debt’s amount, interest rate, and due date

- Determine total monthly debt obligations and what extra you can allocate

Popular repayment methods:

- Avalanche method: Pay off the highest-interest debt first while paying minimums on others. Best for saving money on interest over time.

- Snowball method: Pay off the smallest balance first to gain momentum and motivation. Works well for behavior-driven progress.

Hybrid strategy: Start with snowball for 1–2 quick wins, then switch to avalanche to save more in the long run.

Step 2: Automate and negotiate

- Set up auto-pay for minimum payments to avoid late fees

- Consider debt consolidation loans with lower APRs

- Negotiate APR with credit card companies if you’ve been a reliable customer

- Use balance transfer cards (0% APR intro offers) responsibly if you have excellent credit

Step 3: Refinance when it makes sense

- Student loans: Refinance only if you lose no federal protections and gain significantly lower interest rates

- Auto loans: Refinancing can lower monthly payments if your credit score has improved

Step 4: Avoid new debt while paying off old

- Freeze unnecessary cards or reduce limits to reduce temptation

- Delay large purchases unless essential

- Reframe credit cards as tools, not extensions of income

Debt payoff example:

Paying an extra $150/month on a $5,000 credit card with 22% APR can reduce your payoff time by 2+ years and save $1,800+ in interest.

Useful tools to accelerate debt elimination:

- Undebt.it – customizable debt payoff planner

- Empower – includes debt tracking and net worth tools

- Tally – app that automates credit card debt payments

Mindset matters:

- Celebrate small wins (every balance paid off is a step forward)

- Track progress visually on a debt thermometer chart

- Use community forums (e.g., Reddit’s r/personalfinance) for support and motivation

Strategically eliminating debt frees up cash flow for investing and saving—and boosts your financial confidence along the way.

Step 4: Start Investing Early

Time is your greatest asset. The earlier you start investing, the more powerful compound growth becomes. Even modest contributions can grow into substantial wealth over decades—especially when you begin in your 20s or early 30s.

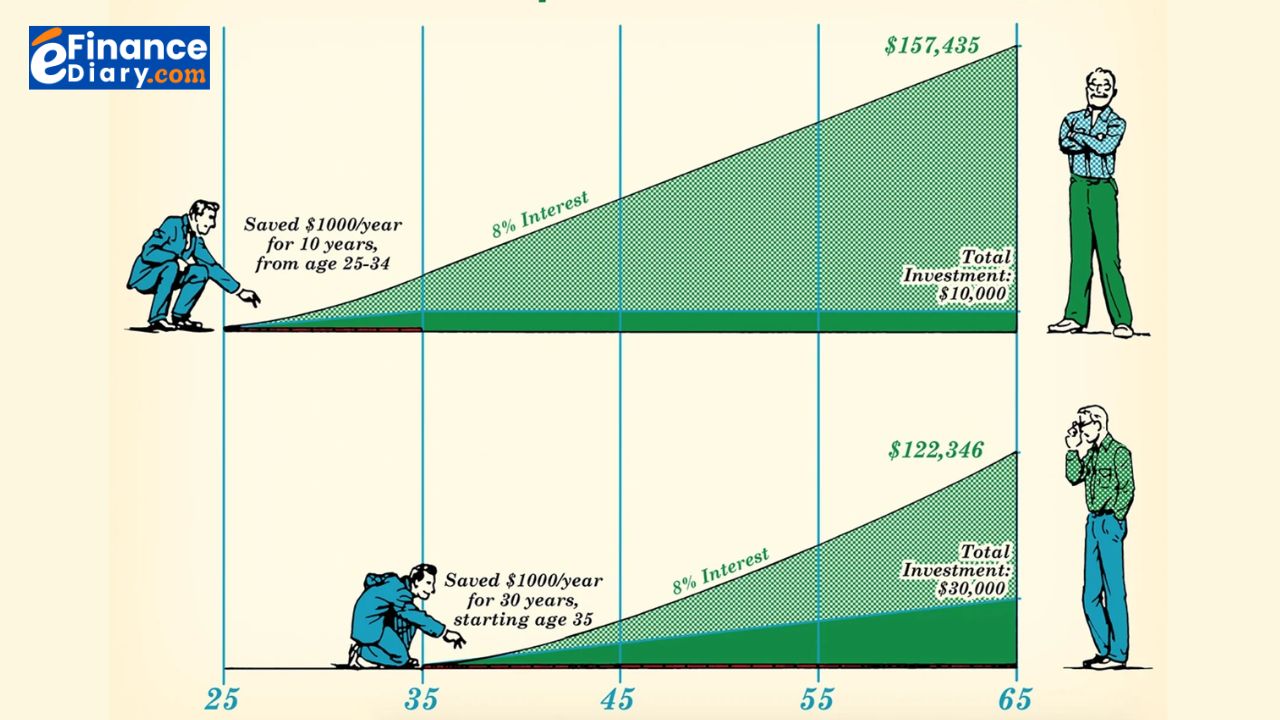

Why starting early matters:

- Compound interest rewards time more than amount. $100/month starting at 25 is worth more than $300/month starting at 35.

- The longer your investment horizon, the more risk you can take—and the greater the potential return.

Investing basics for beginners:

- Start with diversified assets: Low-cost index funds or ETFs (e.g., VTI for total US market, SPY for S&P 500, QQQ for tech exposure).

- Use tax-advantaged accounts:

- Roth IRA: Post-tax contributions with tax-free withdrawals in retirement

- 401(k)/403(b): Employer-sponsored plans—contribute at least enough to get the match

- HSA (Health Savings Account): A hidden retirement gem if eligible

- Set your asset allocation:

- In your 20s/30s: 80–90% stocks, 10–20% bonds or fixed income

- Rebalance yearly to maintain your risk profile

Use automation to your advantage:

- Set up automatic transfers to investment accounts monthly or with every paycheck

- Use robo-advisors like Betterment, Wealthfront, or SoFi to manage your portfolio with minimal effort

- Apps like Acorns round up purchases and invest the change

Best investing platforms for millennials:

- eToro: Ideal for social trading and exposure to crypto and ETFs

- Fidelity or Vanguard: For DIY investors looking for long-term growth and low fees

- M1 Finance: Allows fractional shares, pre-built pies, and auto-investing

- Robinhood or Public: User-friendly for beginners (but watch out for impulse trading)

Investing example:

If you invest $300/month starting at age 25 in an index fund returning 7% annually, you’ll have over $375,000 by age 50. If you wait until 35 to start? Only $173,000—less than half.

Common investing mistakes to avoid:

- Timing the market: Focus on time in the market, not timing it

- Investing based on hype (meme stocks, crypto FOMO)

- Ignoring fees: High-fee mutual funds can eat away at returns

- Not diversifying: Putting all your money in one stock, sector, or asset

- Panicking during market dips: Corrections are normal—stay the course

Tips to stay consistent:

- Use the pay-yourself-first principle: invest right after you get paid

- Increase your monthly contribution with every raise

- Review your portfolio every 6–12 months—not every day

Helpful resources:

- Morningstar: For fund research

- Bogleheads.org: Community of passive investing advocates

- Investopedia: For beginner-friendly definitions and strategy guides

Mental shift: Investing isn’t just for the wealthy—it’s how you become wealthy. Start small, be consistent, and let time do the heavy lifting.

Even if you feel unsure or think it’s “too late,” the best time to invest was yesterday. The second-best time? Today.

Step 5: Protect Your Financial Future

As you build wealth, you need to protect it. Financial security isn’t just about growing your assets—it’s about shielding them from the unexpected. This means building financial resilience through proper safeguards, so one emergency or life event doesn’t derail years of progress.

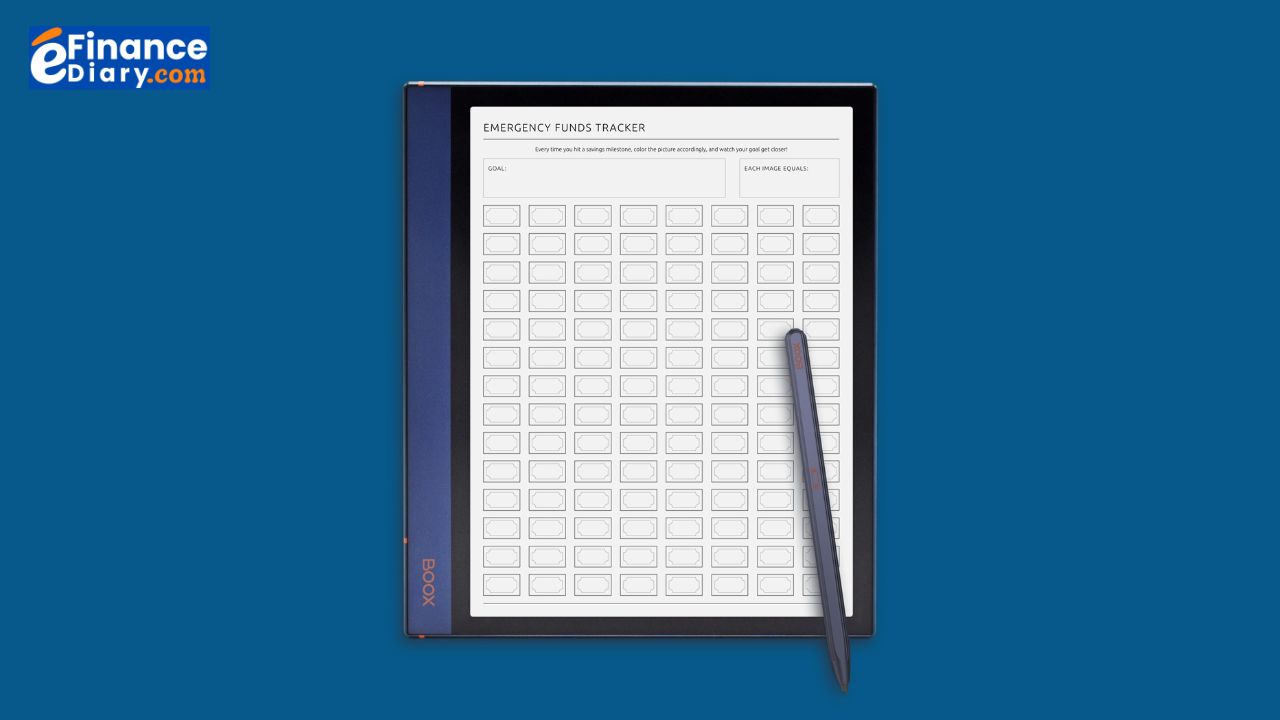

Build a Rock-Solid Emergency Fund

- Aim to save 3–6 months’ worth of essential expenses (rent, groceries, utilities, insurance)

- For freelancers or gig workers, consider 6–12 months due to income variability

- Keep this fund in a high-yield savings account (HYSA) with quick access—but separate from your main spending account

- Avoid investing this money—it’s for liquidity, not returns

Pro Tip: Start with $1,000 as a mini emergency fund, then scale it up over time

Get the Right Types of Insurance

![]()

Insurance is your financial parachute. Having the right coverage prevents minor issues from becoming major setbacks.

- Health Insurance: Even a minor injury can cost thousands without it. Choose a plan that balances premiums with out-of-pocket limits.

- Disability Insurance: Often overlooked but essential. If illness or injury prevents you from working, this replaces lost income.

- Life Insurance (Term): If someone depends on your income (spouse, children, parents), term life coverage is an affordable must-have.

- Renter’s or Home Insurance: Protects your personal property and liability.

- Auto Insurance: State-mandated and protects against accidents and liability.

Tip: Review your coverage annually or after life changes (new job, move, child).

Don’t Skip Estate Planning

It may sound like something only wealthy people need—but everyone needs basic estate planning, even if you’re single or in your 30s.

- Write a will: Decide who gets your assets and who manages your estate

- Assign beneficiaries: Ensure your bank, brokerage, and retirement accounts have up-to-date beneficiaries

- Power of Attorney (POA): Someone you trust who can make legal/financial decisions if you’re incapacitated

- Advance healthcare directive: Outlines your medical wishes if you can’t speak for yourself

Tools: Use platforms like Trust & Will, Fabric, or LegalZoom to create a basic estate plan affordably.

Secure Your Digital Financial Life

- Use a password manager (e.g., 1Password, Bitwarden) to store financial login credentials

- Enable two-factor authentication (2FA) on all banking, investing, and credit accounts

- Regularly review your credit report for suspicious activity (free via AnnualCreditReport.com)

Bonus: Protect Your Identity & Credit

- Freeze your credit with all three bureaus (Experian, TransUnion, Equifax) to prevent fraud

- Consider a credit monitoring service like Credit Karma, Aura, or Identity Guard

- Don’t overshare financial info on public Wi-Fi or social media

Financial protection isn’t a luxury—it’s a necessity. Without it, one illness, accident, or mistake could wipe out everything you’ve worked so hard to build. Just as you wouldn’t drive without insurance or climb without a harness, don’t grow wealth without putting up a safety net.

Common Mistakes Millennials Make in Financial Planning

Financial planning isn’t just about what you do—it’s also about what you avoid. Many millennials fall into the same traps that slow down or sabotage long-term success. Here’s a deeper look at the most common pitfalls and how to avoid them:

-

Lifestyle Inflation

- As income grows, so do expenses. Instead of increasing savings, many millennials upgrade apartments, buy new cars, or spend more on travel and dining. This leads to paycheck-to-paycheck living—even with a higher salary.

- Fix: Maintain your lifestyle for a few years after a raise and direct the extra income toward debt payoff, investing, or savings goals.

-

Delaying Investing

- Many people believe they need a lot of money to start investing, or they wait until they “feel ready.” But the cost of waiting is massive due to lost compound growth.

- Fix: Start with as little as $25/month in a diversified index fund. Automate it and increase the amount as income grows.

-

Not Having Insurance

- Skipping insurance may save money short-term, but one accident, illness, or disaster can create years of financial damage.

- Fix: Prioritize health, renter’s, and auto insurance. Add disability and term life insurance if others depend on your income.

-

Ignoring Credit Scores

- Poor or thin credit history can hurt your chances of getting a loan, renting an apartment, or even landing a job. It can also lead to higher interest rates.

- Fix: Always pay bills on time, keep credit utilization under 30%, and check your report annually for errors.

-

Over-Relying on BNPL or Credit Cards

- Buy Now, Pay Later services and credit cards make it easy to overspend and forget how much you owe. High interest rates and late fees can spiral into long-term debt.

- Fix: Treat credit as a tool, not free money. Use budgeting apps to track purchases and set alerts for due dates.

-

Neglecting an Emergency Fund

- Many millennials skip this foundational step, leaving them vulnerable to job loss, car repairs, or unexpected bills.

- Fix: Start small ($500–$1,000), then build toward 3–6 months’ worth of essential expenses. Keep it in a separate high-yield savings account.

-

Not Talking About Money

- Cultural stigma and discomfort often prevent open conversations about finances. As a result, people make uninformed decisions.

- Fix: Talk about money with friends, partners, and family. Join financial communities online or find a money mentor.

-

Trying to Time the Market

- Jumping in and out of investments based on headlines or fear often leads to buying high and selling low.

- Fix: Focus on long-term investing with a consistent strategy. Use dollar-cost averaging and rebalance once or twice per year.

-

Skipping Goal Setting

- Without goals, it’s easy to spend impulsively and fail to prioritize future needs.

- Fix: Define clear short-, medium-, and long-term goals using the SMART framework.

-

DIY Everything Without Research

-

- Being independent is great—but not reading up on financial tools, tax rules, or investment products can lead to costly mistakes.

- Fix: Read trusted financial blogs, take online courses, and seek professional advice when necessary.

Avoiding these common mistakes won’t just save money—it’ll accelerate your journey toward financial freedom and peace of mind.

Final Thoughts: Start Small, Think Big

Financial planning can feel overwhelming, but it doesn’t have to be. The most important thing is to start now, even if it’s with small steps.

Recap of the 5-step strategy:

- Set clear goals

- Build a smart budget

- Tackle debt

- Start investing early

- Protect your financial future

No matter where you are today—buried in debt, just getting started, or ready to grow your wealth—you have the tools and the time to change your financial story.

Call to Action

- ✅ Download our Free Millennial Money Checklist to kickstart your plan today.

- Join 10,000+ readers receiving weekly financial tips.

- Try our Budget Builder Tool (coming soon).

Related Articles:

- How to Build a Long-Term Investment Portfolio in Your 30s

- Robo-Advisors Explained: Pros, Cons & Top Platforms

- Best Budgeting Apps for Millennials

You’ve got this—one smart decision at a time.